Energy Commodities Trading

Energy commodities are essential resources that fuel the global economy, including oil, natural gas, coal, and renewable energy sources.

What are Energy Commodity CFDs?

Energy Commodities Trading

Energy commodities are essential resources that fuel the global economy, including oil, natural gas, coal, and renewable energy sources.

What are Energy Commodity CFDs?

Top 6 Factors Influencing Energy Prices

Supply and Demand Imbalances directly impact prices, with shortages driving prices up and oversupply lowering them.

Geopolitical Events Conflicts and instability in key regions can disrupt supply, causing price spikes.

OPEC Decisions OPEC’s production targets directly influence global oil supply and prices.

Natural Disasters and Weather Extreme weather and disasters can damage infrastructure and limit supply, leading to price volatility.

Government Regulations Policies and environmental regulations affect production costs and pricing.

Global Economic Conditions Economic growth boosts energy demand and prices, while recessions reduce both.

Top 6 Factors Influencing Energy Prices

Supply and Demand

Imbalances directly impact prices, with shortages driving prices up and oversupply lowering them.

Geopolitical Events

Conflicts and instability in key regions can disrupt supply, causing price spikes.

OPEC Decisions

OPEC’s production targets directly influence global oil supply and prices.

Natural Disasters and Weather

Extreme weather and disasters can damage infrastructure and limit supply, leading to price volatility.

Government Regulations

Policies and environmental regulations affect production costs and pricing.

Global Economic Conditions

Economic growth boosts energy demand and prices, while recessions reduce both.

Why trade Forex with Decode Capital?

Over

100

trading product

Over

0.0 Pips

Raw Spread

Over

20

Years Experience

Support

24/5

Over

100

trading product

Over

0.0 Pips

Raw Spread

Over

20

Years Experience

Support

24/5

support

Tighter Spreads Market leading pricing with spreads from 0.2 pips, 24/5

Faster Execution Low latency, ultra fast execution with servers located in LD3

24/5 Support Customer service provided by our experienced account managers

Advanced Platform MetaTrader 4 on Windows, Mac, and mobile

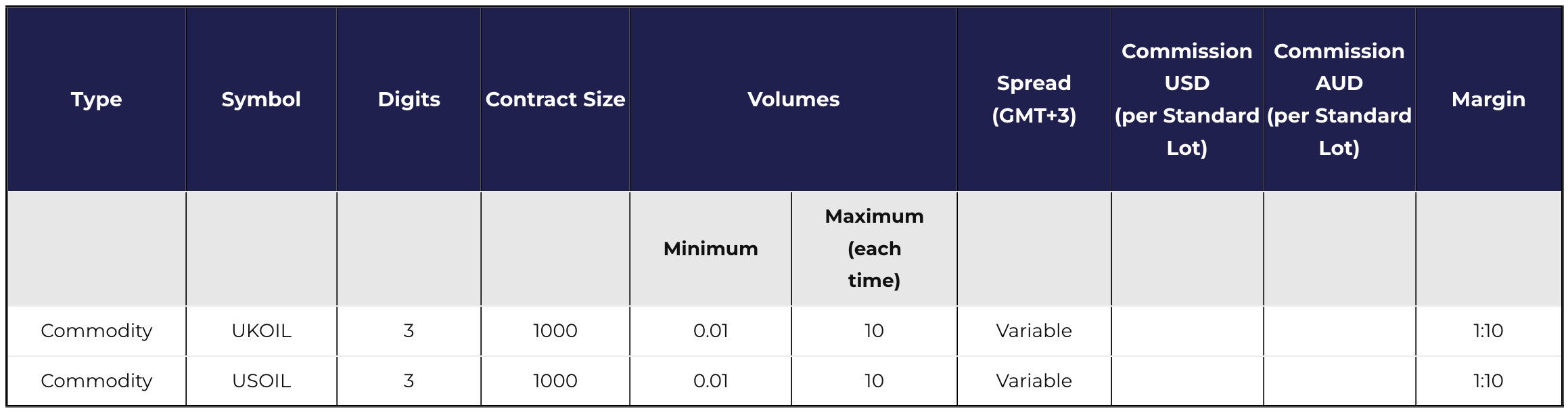

| Type | Symbol | Digits | Contract Size | Volumes | Spread (GMT+3) | Commission USD (per Standard Lot) |

Commission AUD (per Standard Lot) |

Margin | |

|---|---|---|---|---|---|---|---|---|---|

| Minimum | Maximum (each time) | ||||||||

| Commodity | UKOIL | 3 | 1000 | 0.01 | 10 | Variable | 1:10 | ||

| Commodity | USOIL | 3 | 1000 | 0.01 | 10 | Variable | 1:10 | ||

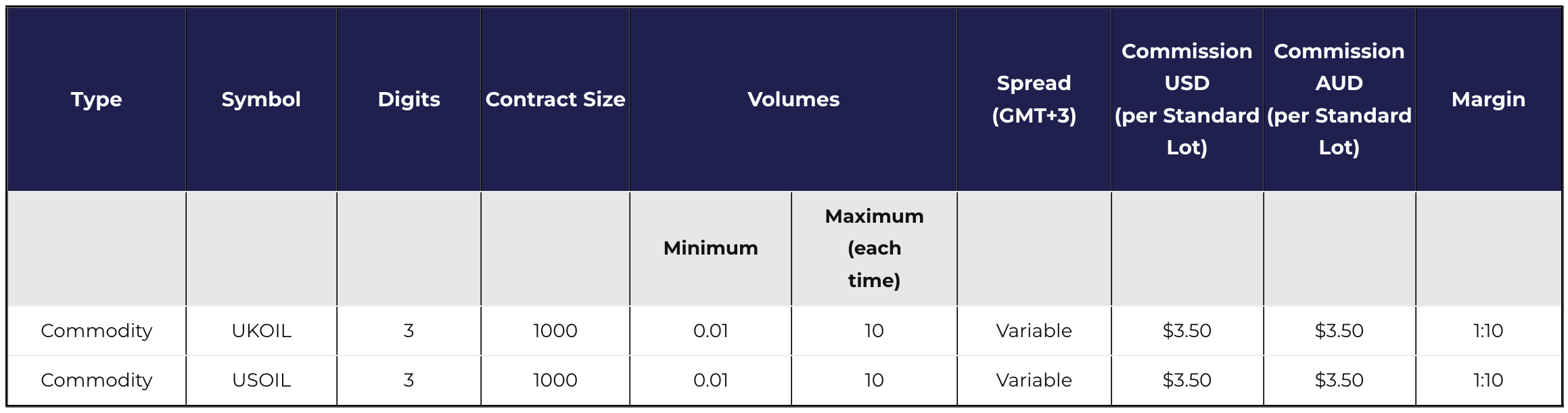

| Type | Symbol | Digits | Contract Size | Volumes | Spread (GMT+3) | Commission USD (per Standard Lot) |

Commission AUD (per Standard Lot) |

Margin | |

|---|---|---|---|---|---|---|---|---|---|

| Minimum | Maximum (each time) | ||||||||

| Commodity | UKOIL | 3 | 1000 | 0.01 | 10 | Variable | $3.50 | $3.50 | 1:10 |

| Commodity | USOIL | 3 | 1000 | 0.01 | 10 | Variable | $3.50 | $3.50 | 1:10 |

If you are looking for a full Product Schedule, please click on Full Product Schedule.