Precious Metals Trading

Trading precious metals through Contracts for Difference (CFDs) offers a flexible and accessible way to speculate on their price movements without the need to own the physical assets.

What are Precious Metals CFDs?

Precious Metals Trading

Trading precious metals through Contracts for Difference (CFDs) offers a flexible and accessible way to speculate on their price movements without the need to own the physical assets.

What are Precious Metals CFDs?

Benefits of Trading Precious Metals CFDs

Leverage CFDs offer the ability to control a larger position with a relatively small amount of capital, which can amplify potential returns. However, leverage also increases risk, so it should be used with caution

Flexibility Traders can take both long (buy) and short (sell) positions, allowing them to profit from both rising and falling markets.

Diverse Market Access Precious metals CFDs provide access to a range of metals, including gold, silver, platinum, and palladium, each with its own market dynamics.

No Physical Handling Trading CFDs means you do not need to physically store or transport the metals, simplifying the trading process.

Safe-Haven Asset Exposure Precious metals, particularly gold, are often seen as safe-haven assets, which can be advantageous during periods of market volatility and economic instability.

Benefits of Trading Precious Metals CFDs

Leverage

CFDs offer the ability to control a larger position with a relatively small amount of capital, which can amplify potential returns. However, leverage also increases risk, so it should be used with caution

Flexibility

Traders can take both long (buy) and short (sell) positions, allowing them to profit from both rising and falling markets.

Diverse Market Access

Precious metals CFDs provide access to a range of metals, including gold, silver, platinum, and palladium, each with its own market dynamics.

No Physical Handling

Trading CFDs means you do not need to physically store or transport the metals, simplifying the trading process.

Safe-Haven Asset Exposure

Precious metals, particularly gold, are often seen as safe-haven assets, which can be advantageous during periods of market volatility and economic instability.

Why trade Forex with Decode Capital?

Over

100

trading product

Over

0.0 Pips

Raw Spread

Over

20

Years Experience

Support

24/5

Over

100

trading product

Over

0.0 Pips

Raw Spread

Over

20

Years Experience

Support

24/5

support

Tighter Spreads Market leading pricing with spreads from 0.2 pips, 24/5

Faster Execution Low latency, ultra fast execution with servers located in LD3

24/5 Support Customer service provided by our experienced account managers

Advanced Platform MetaTrader 4 on Windows, Mac, and mobile

| Type | Symbol | Digits | Contract Size | Volumes | Spread (GMT+3) | Margin | |

|---|---|---|---|---|---|---|---|

| Minimum | Maximum (each time) | ||||||

| CFD | XAUUSD | 2 | 100 | 0.01 | 50 | Variable | 1:20 |

| CFD | XAGUSD | 4 | 5000 | 0.01 | 50 | Variable | 1:10 |

| CFD | XPTUSD | 2 | 100 | 0.01 | 50 | Variable | 1:10 |

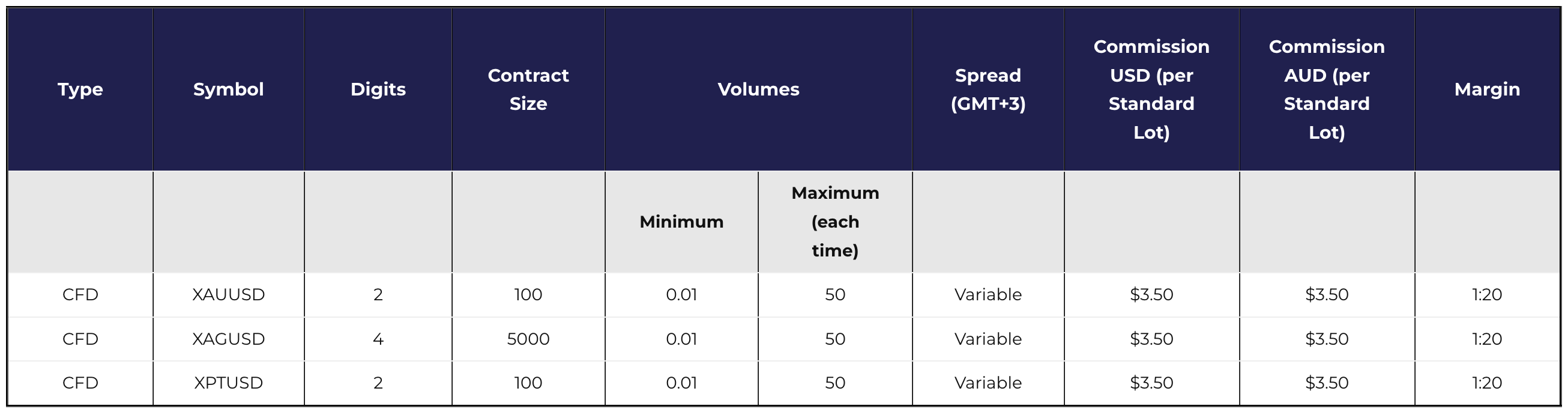

| Type | Symbol | Digits | Contract Size | Volumes | Spread (GMT+3) | Commission USD (per Standard Lot) | Commission AUD (per Standard Lot) | Margin | |

|---|---|---|---|---|---|---|---|---|---|

| Minimum | Maximum (each time) | ||||||||

| CFD | XAUUSD | 2 | 100 | 0.01 | 50 | Variable | $3.50 | $3.50 | 1:20 |

| CFD | XAGUSD | 4 | 5000 | 0.01 | 50 | Variable | $3.50 | $3.50 | 1:20 |

| CFD | XPTUSD | 2 | 100 | 0.01 | 50 | Variable | $3.50 | $3.50 | 1:20 |

If you are looking for a full Product Schedule, please click on Full Product Schedule.