Overnight Wrap-up

- Current bias: “Risk off”

- U.S. data broadly as expected

- U.S. stocks snap win streak as profit takers and Tesla hit sentiment

Markets

It was largely a day of consolidation on currencies overnight, with the market taking a breather after the early volatility this week. No new range extensions were posted and action was classified as fairly two-way.

After the close, U.S. Treasury Secretary Yellen called for a raise to the U.S. debt ceiling, but thi has had little impact on dealings.

Equities backed up a little overnight, with some light profit taking emerging after recent gains, while the major indexes were dragged down by a fall in Tesla stock.

Oil and gold prices continued to rise overnight.

Thoughts

We think the focus of today’s trading will be Chinese inflation numbers. With China being the manufacturer for the world, an increase in Chinese inflation will filter through to all their trading partners. Chinese CPI is expected to rise 1.4% while PPI is slated to rise 12.2%.

Into the Asian open there has been good buying of Yen and gold, which supports our continued risk off bias.

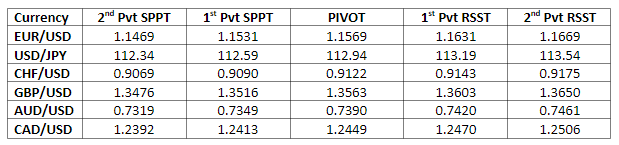

Pivot Points