Themes

- General mood is “risk off”

- U.S. inflation higher than excepted at +0.9% from +0.6% talk

- Poor U.S. 30-year bond auction supported USD, weighed on stocks

What’s Moving

We were waiting for incentives and last night we got them. The combination of higher-than-expected U.S. inflation data with a poor 30-year U.S. bond auction combined to add some volatility into the markets.

The higher inflation numbers saw gold scream higher while the poor bond auction supported the USD (as did short covering after recent Dollar weakness) and weighed on U.S. stocks, which posted their second consecutive weaker close, but ended off the day lows.

Thoughts

Data today sees Japanese inflation data along with Australian Unemployment numbers. There is also a swag of U.K. data set to hit the tapes.

We expect consolidation of overnight movements into early Asia today, although the big red flag is the Australian employment numbers. AUD/USD is weak heading into the data but could swing back hard on a strong number.

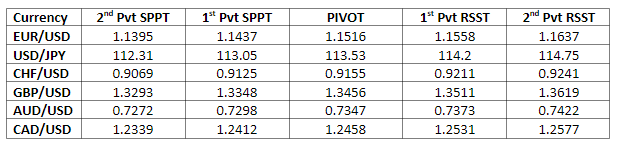

Pivot Points