Themes

- General mood is “risk off”

- U.S. Michigan Consumer Sentiment at 66.8 from 72.5 talk; slightly weaker

- Fed’s Kashkari: Inflation causing pain, but expects it to be temporary

What’s Moving

It was a funny end to the week on Friday, with traders largely ignoring the only major U.S. data release; Michigan Sentiment to see the risk off bias of the week to continue. Despite the softer Sentiment numbers, the USD and U.S. stocks continued to gain over the day. As did the gold price, indicating that the market is firmly looking at the rising inflation indicators worldwide.

Oil prices did come back slightly, with end of week profit taking cited.

Thoughts

The focus in Asia today will be on the Chinese data which is broadly expected to come in better than expected rather than worse. This should see traders continue to look for inflation hedges with stronger Chinese numbers expected to filter through into input costs, which will again increase inflation expectations.

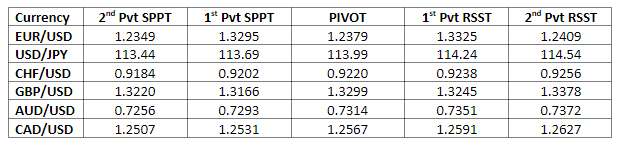

Pivot Points