Themes

- General mood is “risk off”

- U.S. stock markets slightly weaker on the day, but largely drifting

- Fed’s Evans: Looking for inflationary pressures to fall

- USD strength pauses slightly

What’s Moving

US session trade saw the Dollar take a breather amid lower rates and weakness in oil prices. The oil price weakness also saw the CAD outperform all of the majors on the day.

Sterling was also firmer on the day after local inflation numbers kept the door open to a potential near-term rate hike in the U.K.

Oil prices hit their lowest levels since early October after a report showed that the U.S. Strategic Petroleum Reserves fell 3.2mln barrels since June.

Thoughts

No major data in Asia today and little on consequence in Europe tonight as well. We expect consolidation of the overnight moves in our session with eyes to be focused on tonight’s U.S. Initial Claims numbers.

U.S. Initial Claims are expected to come in at 260k from 267k last.

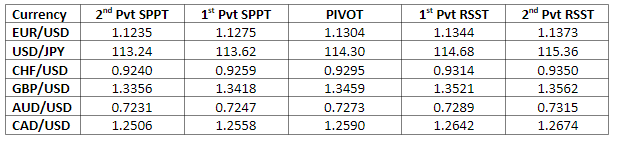

Pivot Points