Themes

- General mood is “risk off”

- U.S. Initial Claims slightly weaker than expected at 268; from 260k talk

- Fed’s Bostic expects normalization of monetary policy by mid 2022

What’s Moving

Biggest mover on the overnight session was again the USD/CAD, with the USD largely consolidating recent strength amid lower yields.

The EUR/USD edged slightly higher in early trade, then stalled and sat there for the rest of New York. Sterling caught a light bid and extended gains slightly, but still seems to be underperforming market sentiment.

U.S. stocks were mixed on the day, with lower yields seeing some tentative buying emerge. The S&P500 and NASDAQ both marked record closes, while the DJIA eased slightly.

All other currency and metal markets largely held recent ranges and traded good two-way price action with no extensions.

Thoughts

Friday in Asia after a consolidatory session in U.S. trade. Expect another quiet day in Asia, with eyes to be trimmed on Japanese CPI data. Nothing else is slated for release. Japanese officials are desperate to move to a more normal monetary policy setting and an uptick in CPI could at least prompt some interesting comments from officials on the tapes.

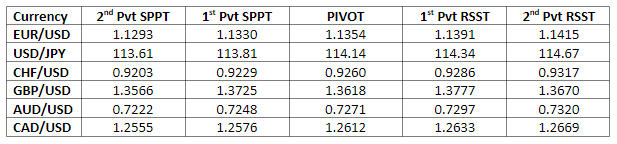

Pivot Points