Themes

- General mood is “risk off”

- German PPI much higher than expected at +3.8% from talk of +2.0%

- U.K. Retail Sales firmer than expected +0.8% from chatter of +0.5%

- Fed’s Williams, Bostic and Waller all edging towards hawkish

Friday session wrap

Hawkish Fed speakers (hawkish meaning they are more apt to raise interest rates) saw another round of USD buying in European and U.S. trade on Friday. Best gains were against the Euro, while the JPY continued to hold its safe haven bid. The Euro was hurt by news of a snap lCOVID lockdown in Austria.

USD/CAD continued to rise strongly, with technicians talking about an “Outside Day Up” pattern on the dailies, which hints to continued further upside.

Stocks were mixed with the NASDAQ ending at a weekly record close while the S&P500 and the DJIA were both slightly weaker.

Thoughts

A Japanese holiday today should account for a quiet start to the trading week in Asia. Data today see Australian PMI, while later this session sees a swag of European and U.S. PMI numbers.

Its hard to make a call on direction with Japan on holidays today, although it is unlikely that recent movements will be reversed due to the reduced liquidity. Expect USD strength to broadly continue over the near-term.

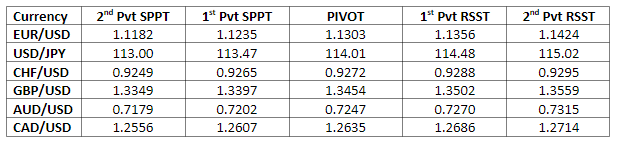

Pivot Points