Themes

- General mood is “risk off”

- U.S. President Biden picks Powell to lead the Fed for a second term

- U.S. Existing Home Sales slightly better than expected at 6.34mln from 6.2mln talk

What’s Moving

A continuation of the “risk off” posture saw the USD remain firm in overnight trading. This was mainly at the expense of commodity currencies, which were also pressured by weaker gold prices.

The announcement that Powell would continue as the Fed Chair saw renewed USD buying, prompting the Euro, Sterling and the Canadian Dollar to hit fresh lows.

Equity market trade was dominated by position adjustment with the DJIA finishing firmer, while the NASDAQ and the S&P500 both sagged.

Gold was slightly weaker on the day, while oil saw a small short-covering bounce.

Thoughts

We are expecting another quiet session in Asia today, with Japan again out on holidays. Data today is light with little more expected than European and U.S. PMI numbers.

Expect the Dollar and Gold to consolidate overnight moves, with little chance expected of a range extension in today’s Asian session.

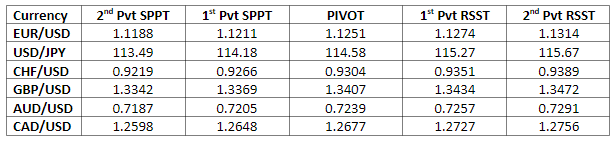

Pivot Points