Themes

- General mood is “risk off”

- Biden announced a U.S. Led coordinated release of global oil reserves

- RNBZ to announce on rates today. Market expects a 25bp hike

What’s Moving

The currency market extended recent gains, amid light volume trade overnight, with the CAD supported by the better oil prices. Other than that it was largely a story of Dollar strength with the market largely ignoring the swag of PMI data to continue down the path of least resistance.

Oil prices had a strong gain overnight, shrugging off news of a U.S. led bid by oil consuming countries to release oil from their strategic reserves. Players ignored this news as it was well priced in.

Equities were mixed, with the NASDAQ weaker on the slightly higher U.S. interest rates, while the DJIA and the S&P500 rose slightly.

Thoughts

Here we are in the same seat with the same (lack of) incentives. Focus in Asia today will be on the RBNZ rate announcement with the market firmly expecting a 25bp rate hike. No move or 25bp should see the NZD fall back slightly, while a hike of greater than 25bps should see the NZD off to the races.

On the majors, expect consolidation of overnight Dollar strength in Asia today.

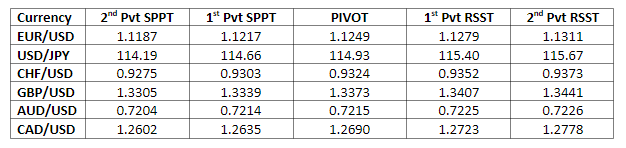

Pivot Points