Themes

- General mood is “risk off”

- U.S. GDP slightly weaker than expected at +2.1% from talk of +2.2%

- U.S. Initial Claims better than expected at 119k from 259k expectations

What’s Moving

A session dominated by USD strength across the board as most players sit on heir hands ahead of tonight’s U.S. Thanksgiving public holiday. The Euro and Sterling tested new lows, while the USD/JPY is continuing to consolidate higher levels.

Key U.S. data was largely ignored overnight for two reasons. Firstly, it was mixed and secondly, most didn’t want to get into new positions ahead of a U.S. three-day weekend.

The NZD continued to test new lows and was the worst performing major on the session after yesterday’s hawkish report (despite 25bp rate hike) from the RBNZ.

Thoughts

Well, if that’s what we are going to get from a U.S. session that includes Initial Claim and GDP numbers, we are expecting very little in Asia today.

In short, the USD and gold should consolidate overnight gains.

Data in Asia today sees little more than the non-market moving Australian Private Capital Expenditure.

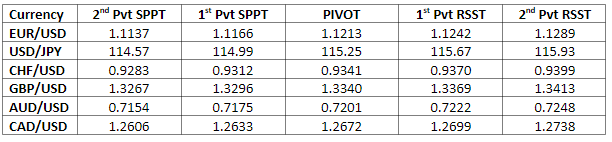

Pivot Points