Themes

-General mood is “risk off”

-Fed’s Evans: If inflation were to increase a lot, a rate hike in 2022 not out of the question

-Fed’s Bowman: Likely to see higher inflation from housing for a while

-New highs again in U.S. equities

What’s Moving

Not much! Tight ranges on all of the major currencies after the more than usual volatility on Monday. The Dollar gave back some of its recent gains, while the Kiwi held and extended its bid on news that New Zealand were to open their boarders after COVID related closures. Swissy got hit on profit taking on recent save haven trades, with some of this money moving into Alt coins after the recent gains on flagship crypto.

U.S. stocks continued to grind higher, with the S&P500 and the DJIA both hitting new historical highs. NASDAQ nudged a new recent high but failed to breach the historical high.

Oil prices continued to grind higher, while gold has also gained new highs.

Thoughts

We are expecting a quiet session in Asia today after yesterday’s volatility. Expect some light profit taking on the Kiwi, but most currencies are awaiting fresh incentives.

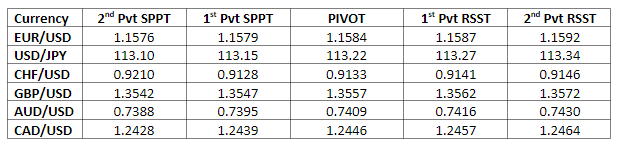

Pivot Points